Bill M. Williams is an American trader and author of books on trading psychology, technical analysis and chaos theory in trading the stock, commodity, and foreign exchange markets.

Day Trading is a methodology whereby positions are only held for or for one day. Daytrading is popular with those who like to explore the market on a more minute by minute basis. This is different from longer-term trades where the “white noise” or “froth” is factored out.

Bill Williams has designed an entire range of personalized indicators which can be learned and used by day traders; Bill Williams fractals and Bill Williams alligator are very popular among day traders.

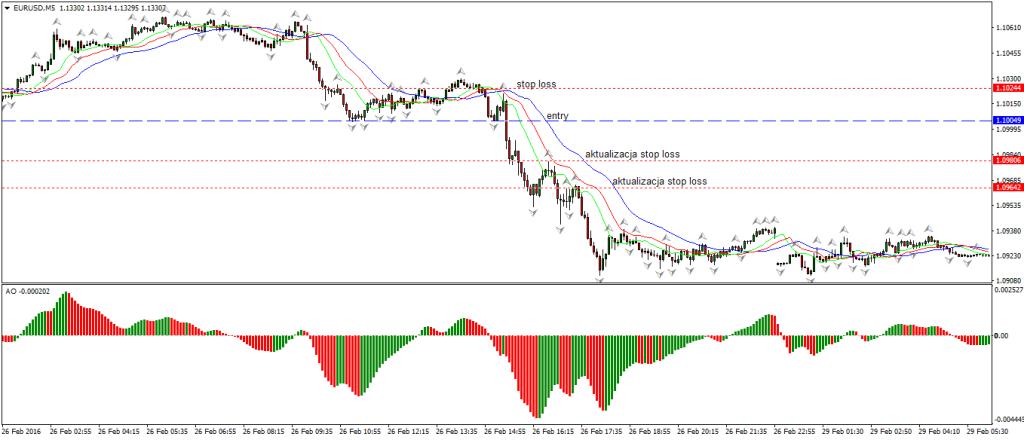

In this strategy, we use low intervals. Five-minute charts (m5) will allow us to react faster in the market so that we can improve our portfolio as a daytrader.

Tools used in this strategy.

All we really need is Bill Williams phone number and email address but since those aren’t available, we will concentrate on his three major indicators; Alligator, Fractals and the Awesome oscillator.

The Alligator is a set of three smoothed edges that resemble the profile the famous reptile. Hence, they are referred to as lips, teeth and jaw. This medium will determine the trend as well as the direction of the trade.

Fractals are an additional tool which provides confidence to the trade. The awesome oscillator dispels any doubts that the setup is worth pursuing.

Entering a position

The fundamental issue is to assess what is the current market trend if any is currently taking place.

The answer to this question will determine the direction of our position.

If we identify a situation in which the lips (green line) are above the teeth (red line) and those, in turn, are above the jaw (blue line), then there is an upward trend.

In contrast, a situation where the lips are below the teeth, and those below the jaw, this means that sellers are dominant, so we have a downward trend.

An additional filter is an Awesome Oscillator.

This aims to further confirm the prevailing trend. It fulfils its role if, after determining the upward trend, the Awesome Oscillator is above the zero line. If the downward trend is identified, the index should be below the zero line. This means that the three parts to the Alligator plus the Awesome Oscillator determine the upward or downward trend that determines the direction of our position.

Then comes the trigger of the entire decision-making process; the Fractals index.

Factors of this indicator are divided into positive and negative. Positive indicates buy, negative a sell.

Each fractal must be constructed of at least five candles. Fractals buy the highest values, and the sell the lowest. A fractal is formed when the middle candle has the highest value of the candles surrounding it in the case of a buy-in fractal. In turn, a sales fractal arises when the middle candle has the lowest value of the surrounding candles. In this way, can identify important points on the chart with a fractal, since each fractal indicates the extremity.

If you identify an upward trend with the Alligator and Awesome Oscillator, the position is taken when the price breaks the buying fractal. If a downward trend is observed, the position is taken when the price chart breaks the sales fracture. It is worth remembering that buy fractals are above the price, while sales below.

Exiting the position

A stop loss is determined in this strategy below the lowest sales fracture, in the case of a buy signal, or above the highest buy-in, for a sell signal. The stop loss should be reviewed upon the creation n of every new fractal.

Money management

This strategy generates signals on a five-minute chart, which causes frequent signals intraday. Therefore, the trader should be prepared to conclude several to several dozen transactions in one session. It is recommended that stop losses for individual transactions do not exceed 0.8% of the investment capital. Caution when selecting the size of exposure allows you to survive any loss that may occur.